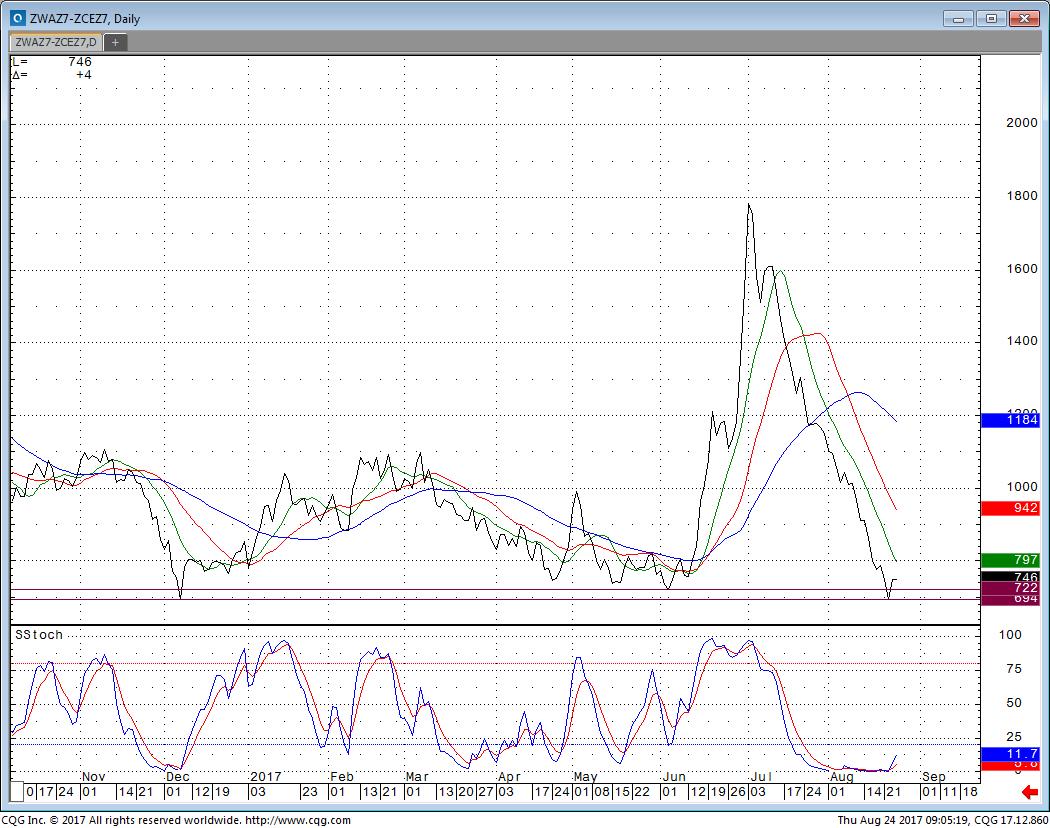

Wheat / Corn Spread

The drop in grain prices has been steady and significant. There will be an area of value where prices support but choosing the exact price in time is difficult. We believe one way to approach “picking a bottom” is to use inter-market spreads. For example, the Wheat vs. Corn. There appears to be some chart support at these lower prices and we believe the price relationship could rebound as much as twenty to thirty cents from current levels. A spread trade is created by simultaneously buying Dec. Wheat and selling Dec. Corn. A correction in the price to a greater difference (from the 73-75 cent range) towards 90 -95 is the goal.

For additional information and risk parameters please contact Mitch LaRocca @ 972-387-0080 or mitch@dallascommodity.com

« All Posts | ‹ Golden Opportunity? | A Common Misconception About the US Dollar Index ›

This material has been prepared by a sales or trading employee or agent of Dallas Commodity Company and is, or is in the nature of, a solicitation. This material is not a research report prepared by Dallas Commodity Company's Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

The risk of loss in trading commodity futures contracts can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain a position in the commodity futures market.