Is everything Golden?

Current global conditions are volatile to say the least. Few sectors have escaped the quick shifts in sentiment seen over the last few weeks. Already in a heightened state of anxiety over oil prices, growth rates and demand concerns, investors were given the headline news shock of negative interest rates in Japan! The almost immediate reaction seemed to be, “If they have to move to negative interest rates to stimulate their economy just how bad are things”? With global stock indexes in a very prolonged, yet tentative bull run, many participants have embraced “risk off” attitudes. As liquidation began and concerns grew the two “safe” areas of choice appear to be the U.S. Treasuries and the Precious Metals markets. Multi-year highs have been reached in both areas.

Now the most frequently asked question is, “Will this continue”? We believe the question should actually be not “if”, but “how long”. Though there are no certainties, but the factors that have been brewing for years (artificially low interest rates, pockets of overvaluation of various assets, over-jealous central bank market involvement, and growing sovereign debt to name a few) are finally weighing heavily on the markets. They seem to sense that globally we are at a crossroads where years of “kicking the can” of fiscal responsibility down the road must stop. Is this the beginning of accelerated debasing of all fiat currencies? Are the problems in China just the beginning? Have we begun to slide down the slope of slower and slower GDP growth coupled with an ever increasing amount of debt? At the very least the markets are showing they are very concerned that the answer might be yes!

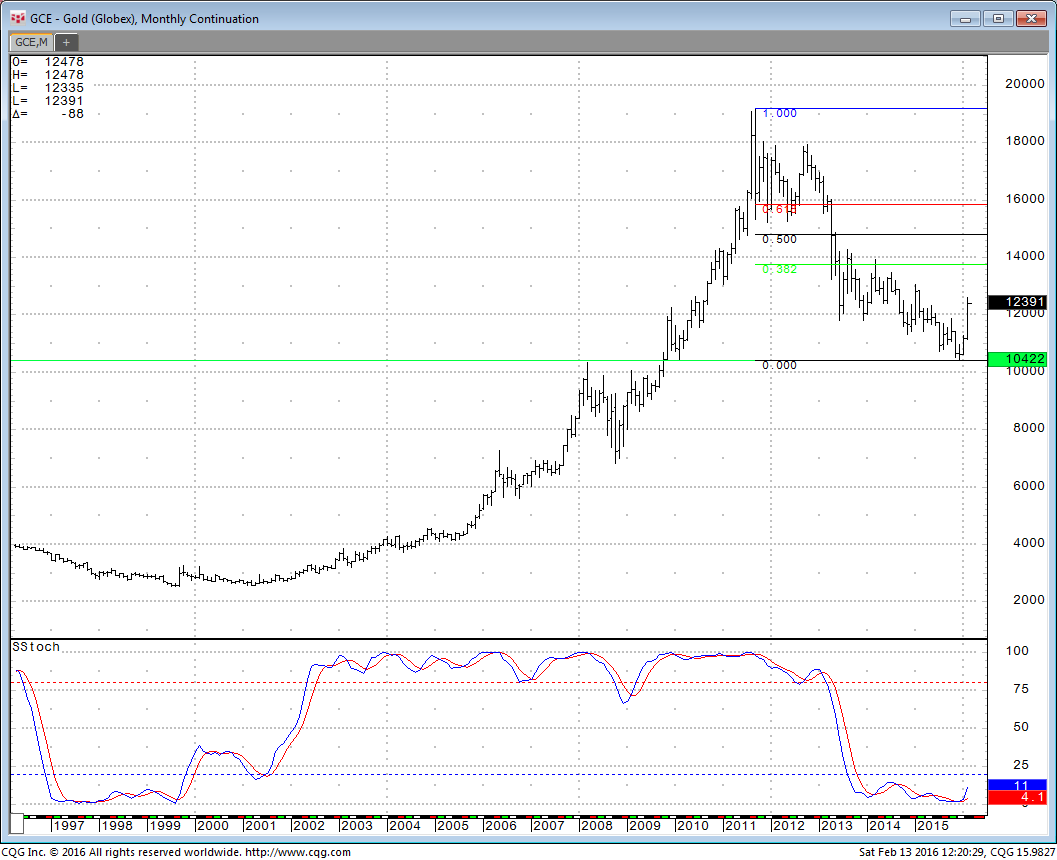

Will Precious metals continue their upward path? After a multi-year slide of between forty and seventy percent the potential is there. Devaluation of currencies, inflation and possibly hyperinflation, have an increasing number of market participants allocating to Gold, Silver and other precious metals. We anticipate some retracement in Gold, possibility a period of some consolidation with a potential for higher prices as investors seek haven from this period of uncertainty. Should the flight away from “riskier” assets continue Gold should benefit as a “safe haven store of wealth”. As shown in the chart below, should Gold regain just 50% of its previous high in 2011, the price could exceed $1,475.00 per ounce. If conditions worsen Gold could even approach it’s record high of approximately $1,920.

See chart below (indicators included).

At Dallas Commodity we’re prepared to assist you in determining the best way to participate in these markets, ranging from individual accounts to professionally managed accounts to the actual taking of physical delivery of the metals. Now is the time to explore truly diversifying your portfolio!

For additional information and risk parameters please contact Mitch LaRocca @ 972-387-0080 or mitch@dallascommodity.com

« All Posts | ‹ Why You Should Own Gold | My Five Drachmas’ Worth ›

This material has been prepared by a sales or trading employee or agent of Dallas Commodity Company and is, or is in the nature of, a solicitation. This material is not a research report prepared by Dallas Commodity Company's Research Department. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions.

The risk of loss in trading commodity futures contracts can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain a position in the commodity futures market.